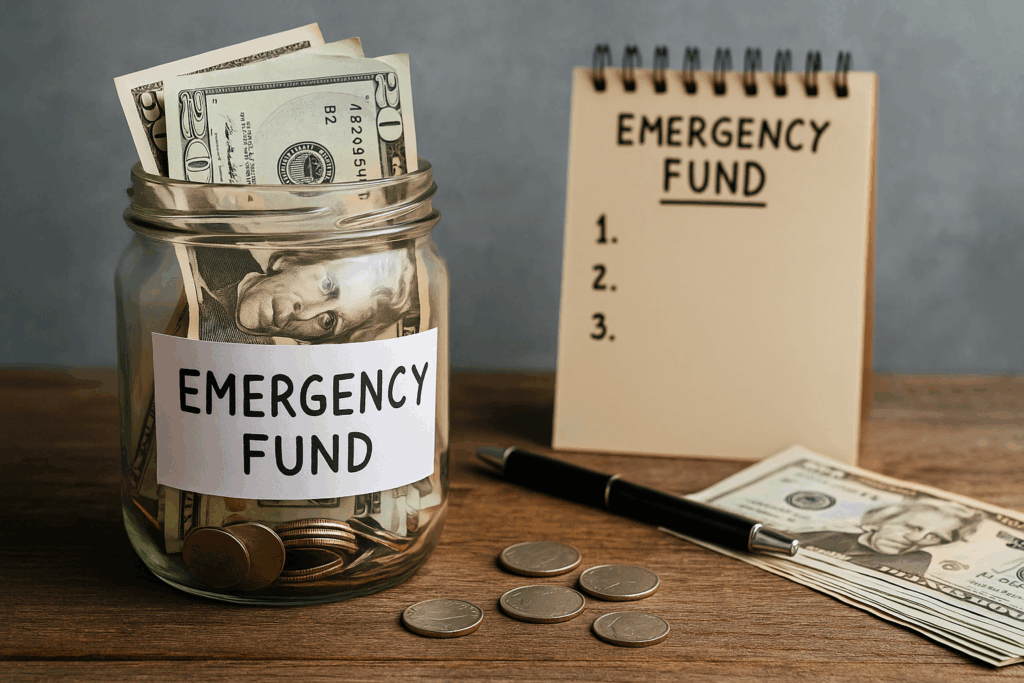

Top Tips to Stay Consistent When Building an Emergency Fund

The concept of an emergency fund—a financial safety net to cover three to six months of essential living expenses—is universally hailed as a cornerstone of solid personal finance. It is the shield that protects your long-term wealth, prevents debt spirals, and, most importantly, provides profound peace of mind. However, knowing you should save and actually […]

Top Tips to Stay Consistent When Building an Emergency Fund Read More »