The stock market is often depicted in popular culture as a chaotic room full of shouting traders or a complex digital web reserved only for the elite. In reality, the stock market is a remarkably logical system designed to solve a fundamental problem: how to move money from people who have it (investors) to companies that need it to grow.

To truly understand how the stock market works, you have to look past the flashing green and red numbers and examine the mechanics of ownership, the psychology of value, and the infrastructure that keeps it all running.

1. The Core Purpose: Why Stocks Exist

At its simplest, a stock (or share) is a piece of paper—now mostly digital—that represents partial ownership of a corporation.

When a company wants to expand—perhaps to build a new factory, develop a life-saving drug, or launch a global satellite network—it has two choices: borrow money (debt) or sell a piece of itself (equity). By choosing the latter, the company performs an Initial Public Offering (IPO). This is the “Primary Market.”

Once those shares are issued, they move to the Secondary Market, which is what we typically call “the stock market.” Here, investors trade shares with each other. The company no longer receives money from these trades; instead, the market acts as a continuous valuation machine, telling the world what the company is worth in real-time.

2. The Mechanics of the Trade: Supply, Demand, and the “Order Book”

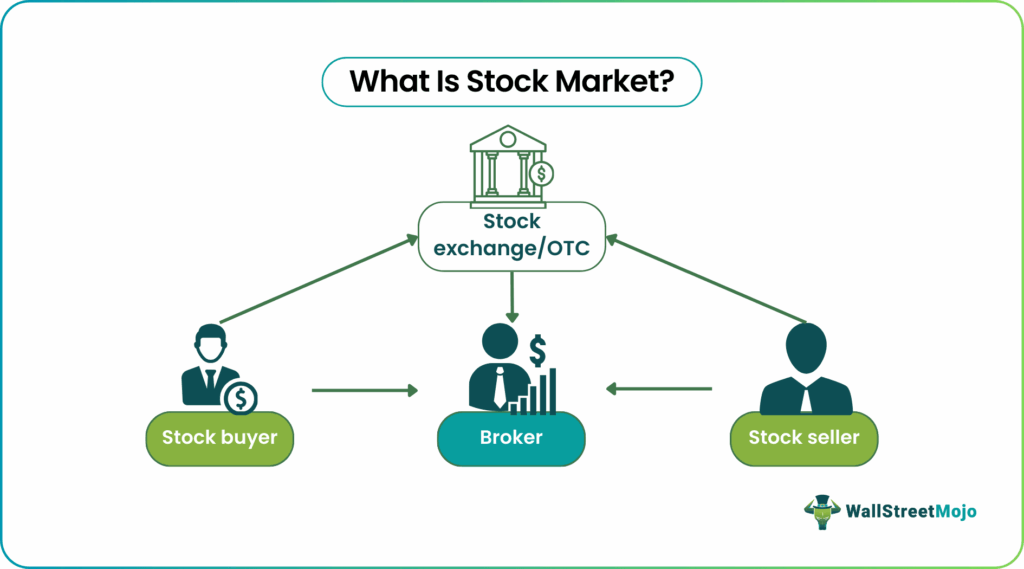

If you buy 10 shares of Apple today, you aren’t buying them from Apple. You are buying them from another person (or institution) who decided today was the right time to sell. But how do you find each other?

This is the job of the Exchange (like the NYSE or NASDAQ) and the Order Book.

- The Bid: The highest price a buyer is willing to pay.

- The Ask: The lowest price a seller is willing to accept.

- The Spread: The gap between the two.

Modern trading happens in milliseconds, powered by Market Makers. These are high-volume traders who constantly provide “liquidity” by being ready to buy or sell at any moment, ensuring that you don’t have to wait hours for a human buyer to appear on the other side of your trade.

3. What Actually Drives Prices?

This is the “Holy Grail” of investing. Why does a stock go up 5% one day and down 3% the next? It comes down to three primary forces:

A. Fundamentals (The Math)

In the long run, a stock price should reflect the company’s ability to generate profit. Investors look at:

- Earnings per Share (EPS): How much profit is attributed to each share.

- Revenue Growth: Is the company selling more than last year?

- Dividends: Actual cash paid back to shareholders.

B. Macroeconomics (The Environment)

Companies don’t exist in a vacuum. If the Federal Reserve raises interest rates, it becomes more expensive for companies to borrow money, and “safer” investments like bonds become more attractive. Consequently, stock prices often fall. Similarly, inflation and unemployment rates shift the “gravity” of the entire market.

C. Sentiment (The Psychology)

This is the most volatile factor. The market is not a calculator; it is a collection of humans (and algorithms programmed by humans). Fear and greed can drive prices far away from their “fair” value. This creates bubbles (where prices are too high) and crashes (where prices are too low).

4. The Role of Indices: Measuring the “Market”

When people say “the market is up,” they are usually referring to an Index.

- S&P 500: Tracks 500 of the largest U.S. companies. It is the most common benchmark for the “health” of the economy.

- Dow Jones (DJIA): A price-weighted index of 30 “blue-chip” companies.

- Nasdaq Composite: Heavily weighted toward technology and growth companies.

Investing in an “Index Fund” allows you to own a tiny slice of every company in that index, effectively betting on the growth of the entire economy rather than a single business.

5. Risk and Reward: The “No Free Lunch” Rule

The stock market offers higher potential returns than a savings account because it carries higher risk.

- Company Risk: The specific business could fail.

- Market Risk: The entire market could drop due to a recession.

- Liquidity Risk: You might not be able to sell your shares quickly at a fair price (rare in big stocks, common in “Penny Stocks”).

To mitigate this, successful investors use Diversification. By owning stocks across different sectors (Tech, Healthcare, Energy) and geographies, they ensure that a disaster in one area doesn’t wipe out their entire portfolio.

6. The Ecosystem: Who Else is Involved?

- Brokers: The apps or firms (like Charles Schwab or Robinhood) that give you access to the exchange.

- Regulators (The SEC): The “police” who ensure companies aren’t lying about their profits and that insiders aren’t cheating.

- Clearinghouses: The invisible intermediaries that ensure the money actually moves from the buyer’s bank to the seller’s bank and the stock moves the other way.

Conclusion: A Tool for Wealth Creation

The stock market is not a casino, though it can be treated like one by speculators. For the disciplined observer, it is a compounding machine. Over long periods, the market has historically trended upward as human innovation leads to more efficient companies and higher global productivity.

Understanding the “why” behind the “how” allows you to stop seeing the market as a mystery and start seeing it as it truly is: a transparent, regulated, and powerful engine for building long-term wealth.